XS2A Platform - technical Solution for PSD2 XS2A

Learn about Business solutions based on FinTechAPI

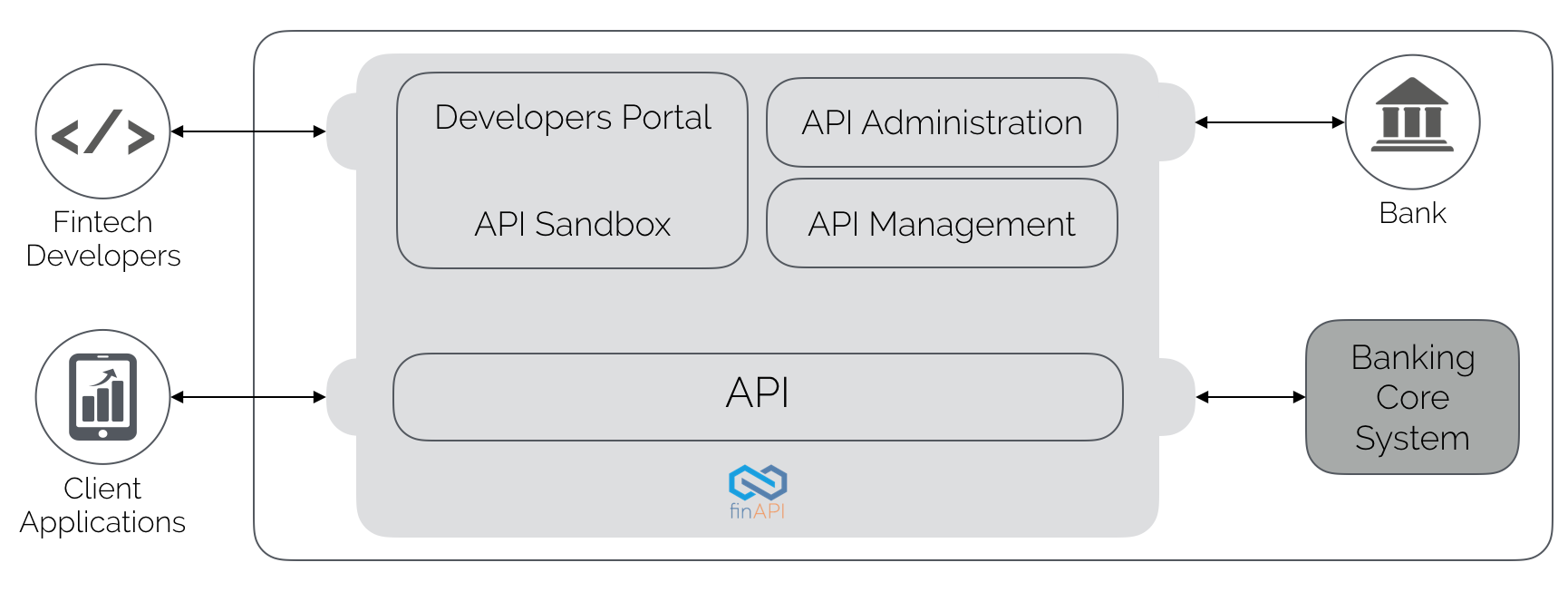

FinTechAPI offers financial institutions a bank-specific XS2A technology, without having to undertake costly and complex adjustments to the bank’s IT infrastructure.

FinTechAPI is a complete, ready-to-use solution for banks that meets PSD2 regulatory requirements. FinTechAPI provides interfaces for access to Account Information (AIS) and Payment Initiation Services (PIS). With our solution bank can accurately control which third-party services can access their AIS and PIS services.

Banks can adopt the FinTechAPI, together with the developers portal, sandbox and custom made APIs in their own IT infrastructure. Integration to core banking processes and internal APIs can be implemented either by the bank IT or the FinTechAPI consultants.

FinTechAPI includes:

Open API

API store & sandbox

API management

API administration

Learn more about PSD2 directive

Learn more about security of our solution

If your bank is interested in joining to financial revolution based on open API standard, please fill in the request form.

REQUEST A DEMO

PSD2 GLOSSARY:

AISP - Account Information Service Providers

API - Application Programming Interfaces

ASPSP - Account Servicing Payment Service Provider

EBA - European Banking Authority

EC - European Commission

EU - European Union

FI - Financial Institution

IFR - Interchange Fee Regulation

OJ - Official Journal

PISP - Payment Initiation Services Providers

PSD - Payment Services Directive

PSD2 - Revised Payment Services Directive

PSP - Payment Service Provider

PSU - Payment service user

RTS - Regulatory Technical Standards

SCA - Strong Customer Authentication

SEPA - Single Euro Payments Area

TPP - Third Party Player

XS2A - Third party access to accounts